February 15, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The ISM Manufacturing Index was 47.4 for January vs. 48.4 for December, while the S&P Purchasing Managers Index was 46.9 for January versus 46.8 for December. From a manufacturing perspective, we remain a bit below 50, which represents a neutral economy. U.S. Factory Orders were up 1.8% for December versus having been down 1.9% for November. The ISM Services Index came in at 55.2 for January vs. 49.6 for December, while the S&P Services PMI was 46.8 for January versus 46.6 for December. Therefore, a mixed bag as it relates to the services side of the U.S. economy. The NFIB Small Business Index was up slightly, to 90.3 in January from 89.8 in December. Overall, the U.S. Unemployment Rate was 3.4% in January versus 3.5% for December, both of which represent a continuing tight labor market. Average hourly earnings were up 0.3% in January versus having been up 0.4% for December. Finally, U.S. consumer prices were up 0.5% for January, a bit more than expected, and up 6.4% for the year ended January 2023.

Fixed Income

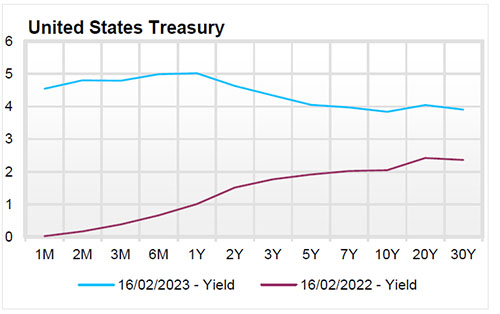

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.78%, 86 basis points below the 2-year yield of 4.64%. At the most recent Federal Reserve Open Market Committee meeting ended February 1st, the Federal Funds Rate range was increased by 0.25%, to 4.50% to 4.75%. In terms of commentary, the FOMC said “the Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.” The FOMC also said that “In determining the extent of future increases in the target range, the Committee will take into account…….the lags with which monetary policy affects economic activity and inflation.” Finally, the FOMC reiterated that “the Committee is strongly committed to return inflation to its 2% objective.” The next FOMC meeting is in late March. Post the most recent meeting, the 6-month U.S. T-bill yield has exceed 5.00% for the first time since 2007.

Yield Curve

Current Generic Bond Yields

Equity

US Equity continues to remain strong with the S&P 500 return 8.25% year-to-date. All eyes are on inflation and the Fed as the January’s core PPI came in hotter than expected, which plays into the dampened disinflation momentum narrative. The more hawkish St. Louis Fed Chair Bullard mentioned he would not rule out a 50bp rise in March, which seemed to knock some of the wind out of the market, though equity continues to remain resilient.

Consumer Discretionary (+19.15%), Communication Services (+17.52%), and Technology (15.79%) lead sectors while Health Care (-2.72%) Utilities (-3.16%), and Consumer Staples (-1.72%) lag. Value and growth are currently a wash with both being +8.24%.

Related Articles

January 1, 2023

The U.S. Index of Leading Economic Indicators was down 1.0% in November versus having been down 0.90% in October.

January 15, 2023

The S&P Manufacturing Purchasing Managers Index came in at 46.7 for December.

February 1, 2023

The Index of Leading Economic Indicators was down 1.0% in December, following a 1.0% move down in November.