January 15, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The S&P Manufacturing Purchasing Managers Index came in at 46.7 for December. The S&P Services PMI came in at 44.7 for December versus 44.4 for November. The ISM Services Index finally broke below 50 as well, coming in at 49.6 for December versus 56.5 for November. The U.S. Unemployment Rate came in at 3.5% for December versus 3.6% for November. Average Hourly Earnings were up 0.3% for December versus 0.4% in November. Consumer Prices were down 0.1% for December versus having been up 0.1% for November. Year-over-year inflation decreased to 6.5%. Finally, the University of Michigan Consumer Sentiment Index came in at 64.6 for January versus 59.7 in December.

Fixed Income

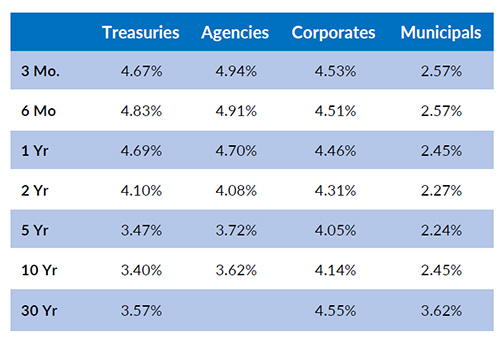

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.51%, 71 basis points below the 2-year yield of 4.22% (the yields are moving daily and as such may be slightly different than the table below). Overall, yields are trading closer to the low end of the recent trading range. Nothing much new to report out of the Federal Reserve Open Market Committee, with exception to the continued verbal commitment to keep interest rates high until inflation moves meaningfully down on an annualized basis. Expectations for the next FOMC meeting is for closer to a 0.25% interest rate increase. The most recent Federal Funds rate increase left the Federal Funds rate range at 4.25% to 4.50%.

Yield Curve

Current Generic Bond Yields

Equity

The S&P 500 started the year off strong with a +4.20% return. Tailwind seems to be found amongst narrative for a soft landing. December’s CPI shows a sixth-straight monthly decline, while the annual increase of 6.5% was the lowest in 14 months. Despite the optimism from the soft-landing narrative and lower CPI, language from the Fed continues to remain hawkish including the expectation to continue to cut near end of year.

All sectors besides Health Care (-0.29%) are positive year-to-date. Communication Services (+9.09%) is rebounding firmly along with Consumer Discretionary (+8.16%) leading the pack. Value (+5.75%) is outperforming Growth (+2.80%) though only fifteen days into the year.

Related Articles

January 1, 2023

The U.S. Index of Leading Economic Indicators was down 1.0% in November versus having been down 0.90% in October.