July 15, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

For the month of June, producer prices increased 2.6% year over year. However, this was overshadowed by the CPI release which revealed consumer prices fell 0.1% over the past month. June CPI data also indicated that prices rose 3.0% in the past 12 months, the lowest percentage increase since June 2023. The ISM Services PMI was 48.8 in June, which resulted in the sharpest contraction in the Index since April 2020. The NFIB Small Business Optimism Index rose to 91.5 in June. U.S. Unemployment Rate rose to 4.1% last month, the highest level since November 2021. Average Hourly Earnings for June increased 3.9% year over year. Lastly, the preliminary University of Michigan Consumer Sentiment Index result was 66, indicating consumers’ views on the economy continue to fall.

Fixed Income

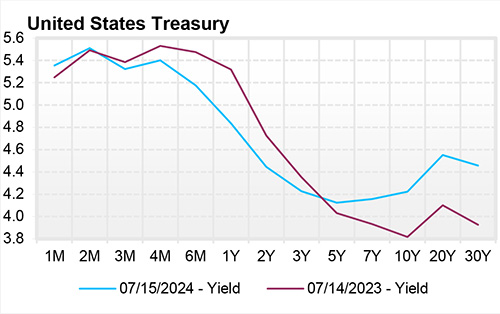

The U.S. Treasury Yield Curve has been inverted since July 2022, one of the longest inversions on record in the modern era, as the Fed has kept target rate range at 5.25 to 5.50. The next FOMC meeting is scheduled for July 30-31, 2024, where no policy rate changes are expected to occur. However, all eyes will be focused on Fed Chair Powell’s comments regarding the risks of softening labor markets, pockets of cooling business activity, and the FOMC’s willingness to cut prior to reaching their stated long-term inflation target. Following the below consensus CPI print this past week, futures markets have priced in a target rate of 4.50-4.75% by the end of the year. Since their recent peak in April, the 2yr and 10yr Treasury yields have decreased by 11.4% and 10.2% respectively.

Yield Curve

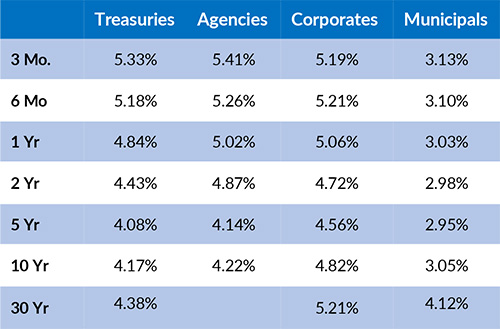

Current Generic Bond Yields

Equity

A true market rally has emerged in recent trade sessions, as the Russell 2000 and REITs have returned over 5% since the start of June. During the same period, the NASDAQ returned 10.38% while the S&P 500 Index posted gains of 6.70%. Equity markets continue to price in a soft landing as U.S. GDP Growth forecasts have cooled and labor conditions have softened in recent months. Most S&P 500 companies will report Q2 Earnings during the next 4 weeks.

Year to date, the best performing sectors have been Information Technology (+33.92%), Communication Services (+26.74%), and Financials (+14.05%). The worst performing sectors this year have been Real Estate (+0.14%), Materials (+5.38%), and Consumer Staples (+8.08%).

Related Articles

June 15, 2024

PPI data for May indicated that producer prices fell 0.2% month over month and have risen 2.2% over the past 12 months.