May 1, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The U.S. Index of Leading Economic Indicators was down 1.2% for March after having been down 0.50% for February. The University of Michigan Consumer Sentiment reading came in at 63.5 for April, essentially flat with March. The Chicago Purchasing Managers’ Index was 48.6 for April versus 43.8 for March, both still contractionary. The NAHB Housing Index was 45.0 for April, up slightly from 44.0 for March, yet both also still contractionary. Finally, new U.S. Single-Family Home Sales came in at 683,000 annualized units in March versus 623,000 annualized units in February.

Fixed Income

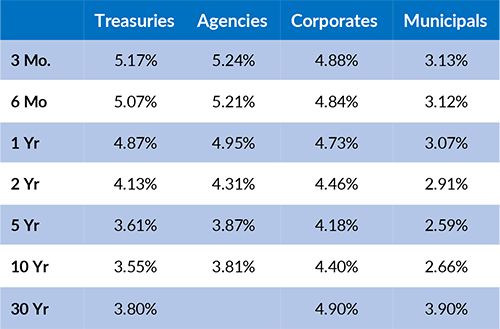

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.34%, 49 basis points below the 2-year yield of 3.83%. At its recent May meeting, the FOMC raised the Federal Funds target rate 0.25%, to a range of 5.00% -5.25%. The minutes of this meeting reflect that the FOMC may be close to ending its recent torrent of interest rate increases. After the meeting, Fed Chair Powell noted, “We feel we are getting closer, or maybe even there.”

Yield Curve

Current Generic Bond Yields

Equity

US Equity finished the month positive as the S&P 500 index rose 1.60% for the month and is up 9.15% year-to-date. The month showed little trading as the VIX (a measurement of S&P 500 volatility) was at the lowest levels seen since November of 2021. Earnings were a big theme this month including positive takeaways such as better than expected regional bank results, FANMAG results, signs of consumer resiliency, and better trends around cost controls, inventories, and supply chain normalization.

More support for a soft-landing scenario was seen in healthy household spending and modest softening in labor markets; however, adversely the same dynamics that support a soft landing could also support the Fed’s higher-for-longer messaging. Future rate hikes by the Fed will continue to depend on if the economy continues to hum and inflation does not recede.

Growth (+11.16%) continues to lead year-to-date over value (+6.90%) with Communication Services (+25.13%), Technology (+21.46%), and Consumer Discretionary (+14.81%) leading sectors. Energy (-1.77%) and Financials (-2.57%) are struggling the most.

Related Articles

March 15, 2023

The U.S. Unemployment Rate came in at a rate of 3.6% for February versus 3.4% for January.

March 31, 2023

U.S. Durable Goods Orders were down 1.0% in February, after having been down 5.0% in January.

April 15, 2023

U.S. Factory Orders were down 0.7% in February versus having been down 2.1% in January.